Control the impact of FX

volatility on your business

Bondford designs bespoke, systematic FX hedging strategies and policies that help to protect profits in volatile markets

FX Risk Challenges

Corporates find themselves in an increasingly competitive and unpredictable business environment where FX volatility is “the norm”.

Conventional FX hedging strategies have become ineffective, and often remain informal. Decision making based on emotion and speculation is commonplace and adds rather than reduces risk.

Without an effective risk strategy and policy, jobs, reputations and businesses are on the line.

Do you adopt a "fire-and-forget" hedge approach?

Large, one-off or ad-hoc hedges, can result in a commitment to a specific spot or forward FX rate on a sizable proporion of your exposure. This can create large, negative P&L impacts and create hedge ineffectiveness. It also limits a firm’s ability to adapt to changing forcasts, or responsibly take advantage of market upside.

Is FX volatility increasing your costs?

It is unlikely that you will be able to continually ask for discounts from your suppliers when exchange rates move against you. This can damage commercial relationships, increase your cost of goods sold and impact profit margins.

Are you losing market share to competitors?

FX volatility may force you to make changes to the pricing of your goods/services in order to keep profit margins intact. This may make you uncompetitive relative to your competition, resulting in a significant reduction in revenue from customers switching to a cheaper supplier.

Is your share price impacted by FX volatility?

Investor demand for earnings growth stability has resulted in finance professionals needing to look beyond hedge performance within a particular fiscal year. Without a more pro-active hedging strategy that creates stable effective hedge rates during and across fiscal years, your stock price could fluctuate significantly.

Are you tired of trying to time hedges correctly?

Without a well-defined, adhered to FX risk policy, explaining when, how much and how far forward to buy foreign currency, finance professionals can lose control over their FX exposure, and it can become easy to adopt more speculative FX hedges which can add volatility to the P&L.

How we can help

We don't have to be smarter than the rest, we have to be more disciplined than the rest.

Warren Buffet

We’re experts in FX risk management

We used to sit on the other side of the table. Now we sit on yours.

Through thousands of client engagements, we understand that many businesses lack the internal resource and expertise to put in place, then administer, an effective FX policy.

With 30+ years experience in the foreign exchange markets, we deliver comprehensive plans that will serve your business now and for many years to come.

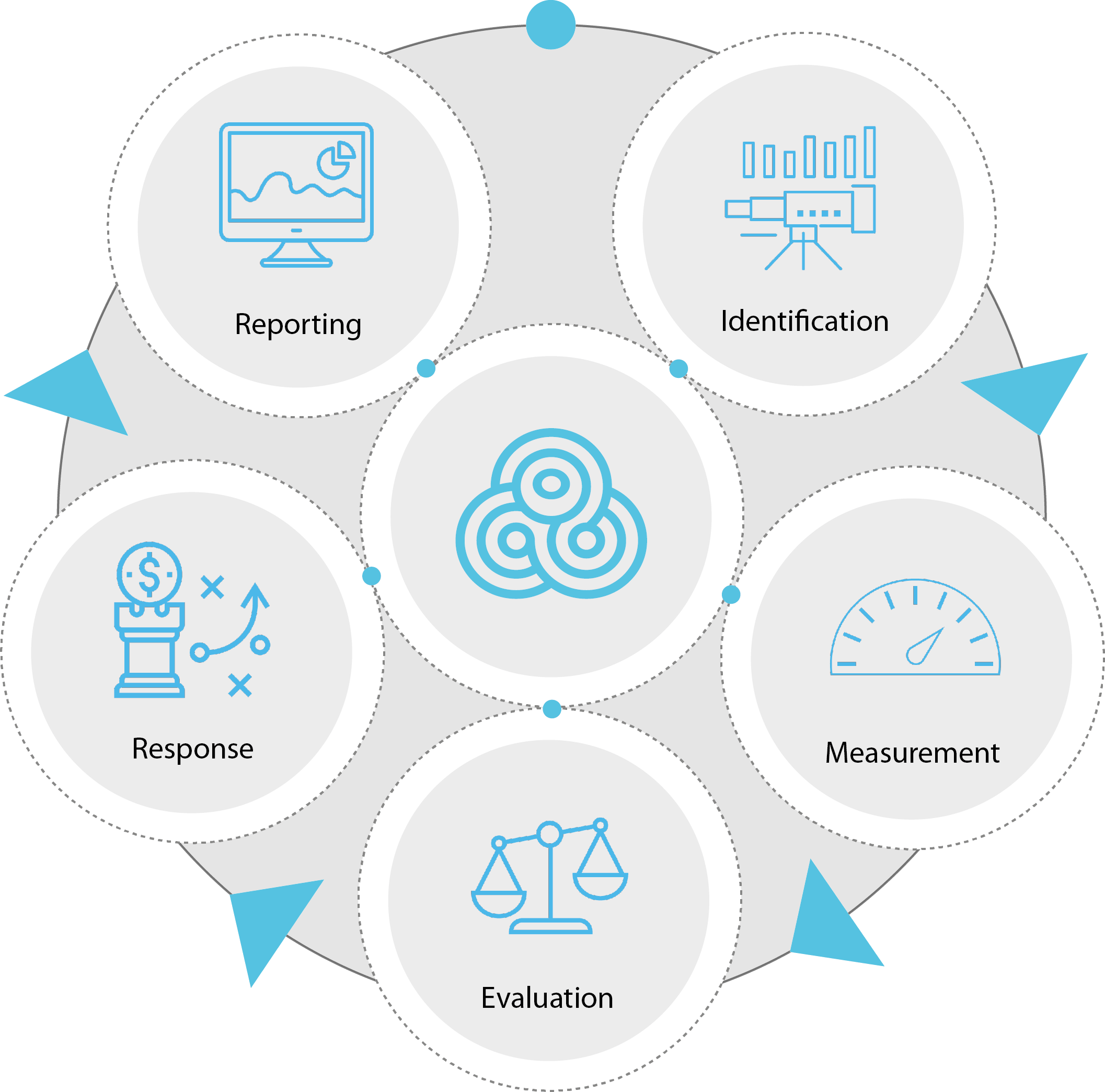

Our FX Risk Management Process

Identification

Analysing your unique exposures

We sit down with you to understand your unique currency flows, operating cycle, and competitive landscape, catagorizing risk by type; transactional, translational, economic.

Measurement

Quantification of risk

With a complete understanding of your FX exposures, we can begin to measure the potential impact of FX volatility on cash-flows, earnings and profits using simulation tools and risk metrics.

Evaluation

Priorities & Objectives

With a comprehensive understanding of your risk exposure and appetite, we’ll agree on priorities and objectives for your FX hedging strategy, including metrics and benchmarks that can later be used for performance evaluation.

Response

A strategy that is right for you

With your objectives and risk appetite in mind, we will independently benchmark a variety of FX hedging programs, using back-testing and simulation analysis to determine the optimal hedge ratio, tenor, frequency and product.

Reporting

Avoid emotion, improve visibility

We will document your bespoke FX hedging policy and continue to measure strategy performance against agreed objectives. This allows for continual review and adaptations based on changes in underlying business or market conditions.

Why must you act now?

Getting started with FX advisory

01. Book a call

We want to learn more about you. Your unique goals and objectives, any challenges you face, and initiatives that you have in mind.

02. We will build you a bespoke FX strategy

With a firm understanding of your objectives, we’ll get to work at designing a best-in-class FX strategy and policy that will provide peace of mind to both you and your shareholders.

03. Grow your business

With less time spent thinking about the currency market, you’ll have more time to focus on your core business.